No peak season is the same. For over twenty years at Pace, during each peak season we’ve worked hard to develop and execute successful peak plans alongside our shipping partners. From our experience, we’ve learned that each year brings with it unique circumstances and uncertainties.

The six essential factors shipping, transportation, and logistics professionals will consider this year include:

- consumer confidence

- labor

- fuel

- economic shutdowns

- inventory, and

- weather

Coming on the heels of an on-going pandemic, delayed startups, and the reopening of local economies, peak season 2021 begs coming to grips with new challenges in forecasting and planning. This year’s uncertainties include staffing appropriately to handle peak volumes and the cost of fuel. Also, what will happen with consumer confidence on a local and national scale? Will our retail shippers have enough inventory and product to meet consumer demand? Finally, there are always the unknowns regarding weather. Perhaps making smart decisions regarding peak this season is more critical than ever.

COVID-19 has continued to impact the logistics world as we head into our planning cycles for peak 2021. Significantly increased time at home in 2020 and into 2021 shifted consumer spending from travel and services to the online purchase of goods. As shelter in place orders took hold around the country at the beginning of the pandemic, the economy predictably shrunk. However, as the summer and fall of 2020 evolved, local economies began to recover to varying degrees. As 2021 unfolds, we are witnessing a continuation of that recovery. Will economic growth continue, and if so, with what demands on additional resources and capacity?

Ensuring a successful peak season has always depended on gathering the best data and business intelligence available, conducting a comprehensive analysis of that information, and then making the best decisions. Then, once a peak plan is created, flawless execution is essential. A successful peak also means adapting as conditions change.

Below are six unique factors to consider for successful peak planning in 2021.

Consumer Confidence

The Conference Board’s measurement of the state of mind of consumers, the consumer confidence index, was unchanged in July at 192.1, up from 128.9 in June, and following five straight months of gains. The University of Michigan’s Consumer Sentiment readings substantiate The Conference Board’s findings.

Lynn Franco, The Conference Board’s Senior Director of Economic Indicators, said “Consumer confidence was flat in July but remains at its highest level since February 2020.” Franco went on to say that “Consumers’ optimism about the short-term outlook didn’t waver, and they continued to expect that business conditions, jobs, and personal financial prospects will improve.” The Conference Board’s position as of July was that consumer spending should continue to support robust economic growth in the second half of 2021. We are still evaluating the economic impact of surges in Delta variant case rates and how this will affect the current trajectory of the CCI.

An additional outlook was presented in mid-June by Bank of America CEO Brian Moynihan. In a CNBC interview, Moynihan said that consumer spending was 20% higher at that point in 2021 versus where it was at the mid-year point in 2019. Moynihan conceded that stimulus money was one factor in the spending numbers, which are based on transaction volumes across Bank of America’s credit and debit cards, and the Zelle payment network.

Personal income measurements are inconclusive for effects on other economic indicators in the short term. May personal income decreased 2% at a monthly rate. The decrease in personal income was attributed to declines in pandemic-related assistance programs.

In late July e-commerce giant Amazon warned in their quarter 2 earnings report that their core e-commerce business was slowing due to COVID-19 vaccines becoming more widely available and consumers returning to traditional brick-and-mortar stores. UPS’s quarter 2 report set guidance going forward slightly below Wall Street expectations. Will consumers truly shift a portion of their spending back to stores aligning with Amazon’s prediction of slowing e-commerce volumes, but still resulting in overall continued consumption? Only time will tell.

All considered, analysts’ crystal balls are murky about peak volumes, but prudence would suggest giving an edge to the heavier side as the best approach to preparation.

Labor

Labor is another matter. Throughout the summer, employers were are having difficulty finding enough workers to hire. Contrary to the outlook of many economists as the economy reopened, a lot of people are not returning to work. Work-life balance and greater flexibility in working conditions are one of the reported considerations. Working remotely “worked,” and many professionals have decided that they may not return to the office if demanded by their employer. They are shopping their talents and contributions on their own terms, not on employers’ terms. For some workers, childcare responsibilities and lack of available options are taking a toll on their ability to return to work. Some workers are concerned about virus exposure, and others have decided to leverage their skills and bargain for a new job with more pay. Many workers have bargaining power and the motivation to use it. As we begin Q4, expired supplemental unemployment benefits as well as the Child Tax Credit will continue to make their impact.

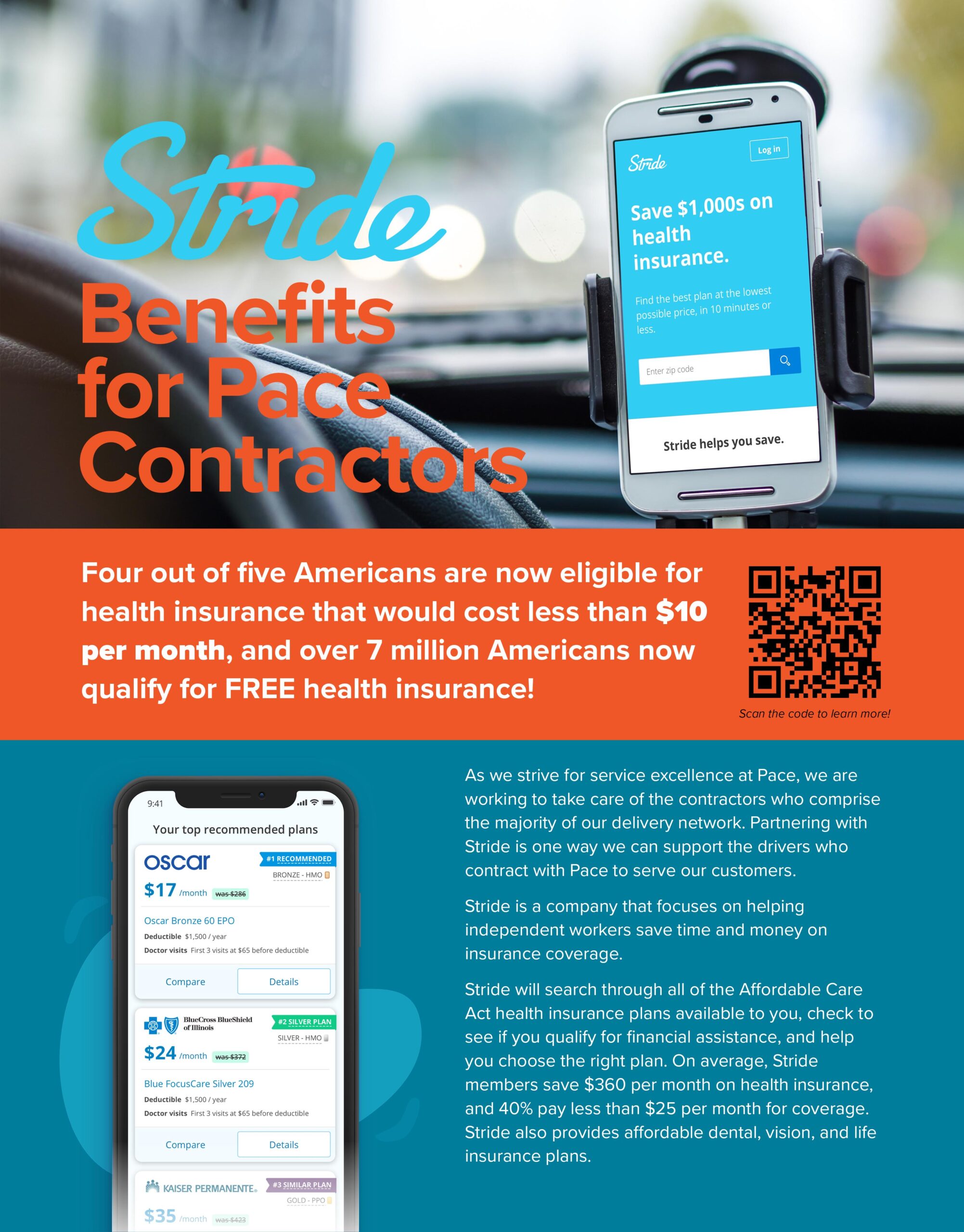

In the world of logistics, we’d be remiss to not mention the driver shortage. An already-shifting demographic in the driver population compounded by current market conditions has ignited demand for drivers. Freight partners and third party logistics providers are working harder than ever to secure and retain talented drivers. In addition to competitive pay along with steady, reliable work, drivers are looking for companies who offer more. At Pace, we’re dedicated to attracting and retaining talented drivers by offering accessible benefits support for our independent owner-operators through Stride; by nurturing relationships with preferred carriers, and helping them grow their business within our network; and by launching a new comprehensive mobile solution – Drive by Pace. Our mobile app makes it easier than ever for drivers to access performance, pay, and new routes.

Fuel

The costs of fuel are always at play in logistics and transportation. This year and its upcoming peak season are no exception. Data reported by the U.S. Energy Information Administration show that the average prices for gasoline and diesel fuel have hit their highest level in seven years, up around 40% since January. Some of this increase would be expected considering the opening of the economy from last year’s mandated lockdowns and increased travel this year. However, attempting to read the tea leaves to predict what will happen this holiday season is tricky. Analysts see the fuel price rate of increase slowing down but continuing to creep up. Logistics planners preparing cost estimates for peak will react accordingly.

Economic Shutdowns

The news about increased infection rates and the high transmissibility of the Delta variant resulted in shifting guidance from the Centers for Disease Control and Prevention, including recommended universal masking indoors in areas with high COVID-19 infection rates. The longer-term impact of the Delta surge on local economies remains to be seen. On the one hand, the Amazon warning that shoppers were returning to brick-and-mortar retail stores may be tempered as consumers reconsider their shopping behavior for the holidays. Shopping volumes may return to e-commerce, and the dynamics of the peak season may shift. If these concerns diminish over the next few months, then the retail peak season could very well be a mixture of 2019 and 2020’s fall peaks. The planning for peak amongst shippers, third-party logistics providers, and those of us in the freight transportation sector should be nimble as we enter peak season this year.

Inventory

Shippers may face inventory shortages as peak season unfolds. It’s generally accepted that peak shipping season usually starts in mid-August and continues to build to a crescendo between Thanksgiving and the late December holiday season. This period is prime time for retailers, increasing demand across multiple markets, as retailers begin building inventory for back-to-school shopping and the holiday season.

Looming over the horizon are continued backlogs of inbound freight at United States ports. In late July, the Marine Exchange of Southern California reported near record highs in delays at the ports of Los Angeles and Long Beach. The two ports account for about forty percent of freight imported into the country and have experienced increasingly severe backups and congestion for months. In July, there were thirty-three inbound ships loaded with freight anchored off the coast waiting for a spot to open for unloading. Now in October, there have been reported as many as sixty cargo ships waiting outside the Port of Los Angeles. In an effort to ease congestion, these two West Coast ports are beginning round-the-clock operations along with commitments by FedEx, UPS, Walmart, and The Home Depot to operate on expanded hours. Kip Louttit, executive director of the Marine Exchange of Southern California, said that “The two ports are facing more congestion than ever. The normal number of container ships at anchor is between zero and one,” in comments to Business Insider. “Part of the problem is the ships are double or triple the size of the ships we were seeing 10 to 15 years ago,” Louttit continued. “They take longer to unload. You need more trucks, more trains, more warehouses to put the cargo.”

Despite efforts to reroute container ships to other ports, the availability of inbound freight inventory that retailers and other importing shippers are depending on to satisfy consumer demand during peak may continue to be a concern. If the volumes but also the congestion problems continue to grow, and the demand for capacity in trucks, trains, and warehouses escalate, costs could rise. Logistics and freight transportation planners will be required to carefully consider contingency planning.

Weather

As always, weather on a local, regional, and even national level will have to be considered by peak logistics planners. We have historical weather data that will be inputted into planning. But weather – and its effects on transportation and freight delivery on-time service, the availability of staff for logistics operations, and the effect on consumers – is always a wild card.

Implementing a Successful Peak Season Plan

Peak seasons are always unique. Peak planning relies on marrying historical data with tried-and-true tactics and processes. Current market situations and forecasts are added to the equation, and the potential best, middle, and worst-case scenarios are considered. Eventually, we arrive at our best and most attainable peak strategy.

Implementing a successful peak season strategy includes:

- Developing a plan that takes into consideration these 6 unique factors

- Executing the peak plan but adapting as factors change

- Understanding the capabilities of your freight providers and leveraging their logistics expertise

Securing a third party logistics provider like Pace who matches the service offerings and freight transportation support you require during peak season can help ensure that implementing your peak plan is a success.